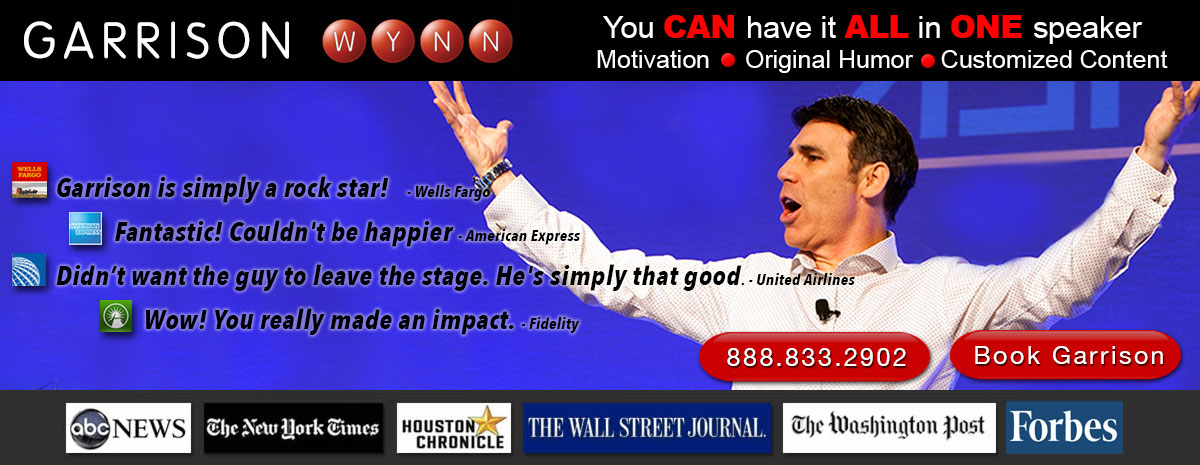

Economic Speaker Garrison Wynn:

Success in a Recession

Participants Learn:

- How to sustain excellence in times of change

- How to gain and keep influence in a difficult economy

- How not to let the media make you feel the world is coming to an end

- What the top 1% do differently and why they won't tell you

- Their value and the role they play in your organization's success

How can economic pressure build success? The U.S. market is no longer the elephant in the room that nobody wants to talk about. Tough economic times are here, making it increasingly difficult to maintain employee morale and customer loyalty.

Author and success expert Garrison Wynn discusses how success in a difficult economy requires more than just being good at what you do — it's about being consistently chosen to do it. He explains why buyers select your competitors' products, services or leadership styles — or your own. The sales version of this program covers how to turn buyers' objections into catalysts for success in tough times.

Do not let the media convince you that this economy offers no hope for success. Find out how top performers are making the most of this economy; learn what they're doing right now that makes them so effective in tough times and cements them as go-to people as economic conditions improve. These research-based, motivational and entertaining sessions provide tips, tools and techniques to help people navigate through difficulties and prepare for a successful future.

![]()

Presentations for Success in a Difficult Economy

Getting Great Results When Things Aren't Really That Great

This entertaining, insightful keynote combines relationship building with no-fluff motivation and change to deliver real solutions in uncertain times. Economic speaker and business relationship expert Garrison Wynn examines the challenges we face and shows how we can laugh at our problems while using them as catalysts for success. This session provides influence tips in times of change through research-based, easily implemented, proven solutions you can use right away.

Objectives:

- Sustaining excellence

- Gaining and keeping influence in a difficult economy

- Not letting the media make you feel the world is coming to an end

- Learning what the top 1% do differently and why they won't tell you

- Knowing how valuable you are in the role you play in your organization's success

![]()

The Real Truth about Success:

What the Top 1% Do Differently and Why They Won't Tell You

A decade of Wynn Solutions research reveals what makes owners and managers of top-performing businesses so effective–and it's not what you'd expect! If you enter this keynote session expecting to learn all about best practices and superior products, you'd better read the title again.

Standout success in a difficult economy often comes from personal advantage–whether it's cosmetic, leadership communication, personality, resources or access to privileged information. Top performers rarely acknowledge this because it tends to make their success sound less impressive or undeserved.

Prepare to laugh and learn as Garrison leads program segments that include:

- Lies about success–and why we believe them

- From interview to confession: The research

- Why would anybody want to be in a fair fight?

- Create your own advantage in leadership and business development

- The truth about success™

- Being the best vs. being consistently chosen

- Action and adaptability create opportunity

- Establish a repeatable process for success

![]()

How To Win An Unfair fight:

Influencing people you no authority over

A great idea is rarely good enough. Sound, well-structured logic regularly loses out to mediocre ideas from people who really know how to influence. This enlightening, research-based session delves into the human condition, revealing that the true key to influence is not intelligence or logic but an understanding of what people really value. Through a collaborative toolkit, this program delivers the tips and strategies you need to make people see the value of your ideas so you're well positioned to gain agreement.

Program segments include:

- Gaining an understanding of what people really value and how that impacts agreement

- Developing strategic advocates and create your own personal "influence upward " plan

- How to get people to agree with you

- Why some people disagree with everything and what you can do about it

- How to get people to listen to your ideas

- Managing your boss: How to help your supervisor make your job easier

- How to gain more influence from any position in your organization

- Reading between the lines: Learning how to adjust your approach

- How to hold people more accountable on projects without conflict

- How to make sure your input is seen as consistently valuable to others

- Creating a repeatable process for agreement: Making the tools work well

![]()

Garrison, you were even more of a hit than I had hoped! My expectations were met and exceeded. The time you spent with our team researching our needs and learning about our business challenges during this tough market definitely paid off.

The audience has been singing your praises. They all feel you had a great understanding of our business challenges, and were darn funny at the same time!

Your presentation was the perfect mix of a serious, business-based message, motivation, and a very funny and engaging delivery. The professionalism and efficiency of you and your team made my life easier!

Delphi Corporation

![]()

Friday, October 10, 2008 | Modified: Wednesday, October 15, 2008

Sky-is-falling' reports snowball troubled times

Houston Business Journal - by Nicole Bradford Reporter

Garrison Wynn, president of Wynn Solutions, believes much of the lost consumer confidence comes from media reports that ‘paint the worst possible picture.' The news of the economy's demise has been, according to some Houston experts, greatly exaggerated.

"The news was talking about a ‘depression,' " says Garrison Wynn, trainer, speaker and author with Wynn Solutions, who takes exception to the media coverage that uses such phrases to describe the U.S. economy. "I can't believe they said that in an article," Wynn says. "In the 1920s, you could have $2 million, the stock market plummets and you could wake up in the morning owing $2 million. One day you own a train and the next day you are a hobo riding on it. That's the kind of thing that was possible. It's not now."

Local experts agree that Houston has always been buffered somewhat from national economic troubles. ("Houston is the reverse of New York," Wynn says. "If you can't make it here, you can't make it anywhere.") But as the forecast becomes cloudier, Houstonians, too, become nervous and more cautious with spending. A vicious cycle of frightened consumers who tighten spending tends to snowball the problem.

"The media paints the worst possible picture, and consumer confidence goes down," he says. "Your belief system creates your experience. The media shapes how you feel, and if you feel we are headed for the worst of times, you hang on to your money. You stop spending — and the economy slows. "If everyone went out and spent money, it would help," he says. "But right now that sounds insane."

"Confidence is the key to a turnaround," says Ron Brounes, CPA, technical financial writer and president of consulting firm Brounes & Associates. "Without it, the global economy will continue its downward spiral. Banks must have confidence to lend. Businesses and consumers must have confidence — and ability — to borrow and spend. Investors must have confidence to put those hard-earned dollars to work in functioning markets."

The American dream?

Despite being shielded from the national elements somewhat, Houston home sales have steadily dropped and a Halloween e-cartoon featuring a group of trick-or-treaters surrounded by empty houses with foreclosure signs is making the rounds.

"Banks may find it difficult to help you like they once did," Wynn says, "especially if you are credit challenged."

In the case of lending institutions that were not proactive in strategizing a "business development culture," as he calls it, waiting around for loan applications to be dropped off would prove a useful activity only part of the time. "Some Banks needed to hire people who could sell, train them and develop a sales culture that says, ‘We are bankers and we're going to help you,' " says Wynn, who provides training for the sales forces of several banks. "The banks that didn't do that found themselves in a different situation, and what happens is basically, they start offering loans to the easiest people to attract, which happens to be the people who can least afford them."

The mortgage crisis of the past year resulted from a "new kind of loan" — one that would result in a dangerous blow to the economy. "Mr. and Mrs. $43,000 a year were able to buy a $300,000 house," he says. "It was the American dream, but it was just a dream — and it doesn't work. The reality was they couldn't afford to buy that house."

The good news

Banks in Texas, particularly those in the Houston metropolitan area and rural areas of the state, continue to perform better than banks across the rest of the nation, according to a recent report by Sheshunoff & Co. Investment Banking, a merger and acquisitions valuation advisory firm for the banking industry. The exception, the company said, are banks in the Dallas/Fort Worth area.

While 14 banks failed across the nation in 2008, including the FDIC-assisted sale of $307 billion Washington Mutual and the $812 billion Wachovia in the last week, Texas institutions are fundamentally strong, the report says.

Woodforest National Bank reported on Sept. 30 that its third quarter earnings were at a record level. CEO Robert E. Marling Jr. also announced that 2008 will reflect the best earnings period in the history of the bank. "This is a testament to the fact that we stayed away from subprime loans, purchasing investments that proved to be toxic or lending money outside of our community, all of which has led to significant problems in the financial sector," Marling says.

"The best lessons come from the worst situations," Wynn says. "The good news is it is possible to learn big lessons from this. Texas probably suffers the least. We have a good economy in Texas and in Houston more than anywhere." For their customers now struggling to plan through tough times, Wynn recommends banks take a short-term, flexible approach that will help customers in the short term and build loyalty in the long term.

"You may need to step away from the brilliant long-term solutions you've developed," he says. "If someone is drowning, you want to throw him a life preserver and not teach him how to build a boat. Where you may be worried about long term, they may be worried about Friday, the end of the month and the end of the quarter."

Can banks recover?

"Yes," Wynn says, "but they have to get back to the basics and that's means prospecting for the customers with money and informing others that renting is not so bad. If we are honest with people about the American dream then it won't be just a dream."